Why China Warned Walmart? Walmart, controlled by the world’s wealthiest family, depends on Chinese suppliers with minimal profit margins for 60% of its global supply chain. However, Walmart is now trying to throw its Chinese partners under the bus to please Trump, and Beijing won’t tolerate this kind of betrayal. 中國為何警告沃爾瑪?由全球最富有家族控制的沃爾瑪,其全球供應鏈的60%依賴利潤率極低的中國供應商。然而,沃爾瑪現在正試圖將其中國合作夥伴置於公共汽車之下以取悅川普,而北京不會容忍這種背叛 March 19 2025

On March 12, the Chinese Ministry of Commerce issued a stern warning to Walmart.

The root cause traces back to Trump’s new tariff war. On March 3, the US announced two additional tariff hikes totaling 20% on Chinese goods. By March 6, Reuters revealed that Walmart was demanding that Chinese textile suppliers implement an immediate 10% price cut followed by phased reductions totaling 20%. This clearly showed Walmart’s attempt to fully transfer Trump-induced losses to Chinese suppliers. Chinese official media immediately pointed out that this was disrupting the market order.

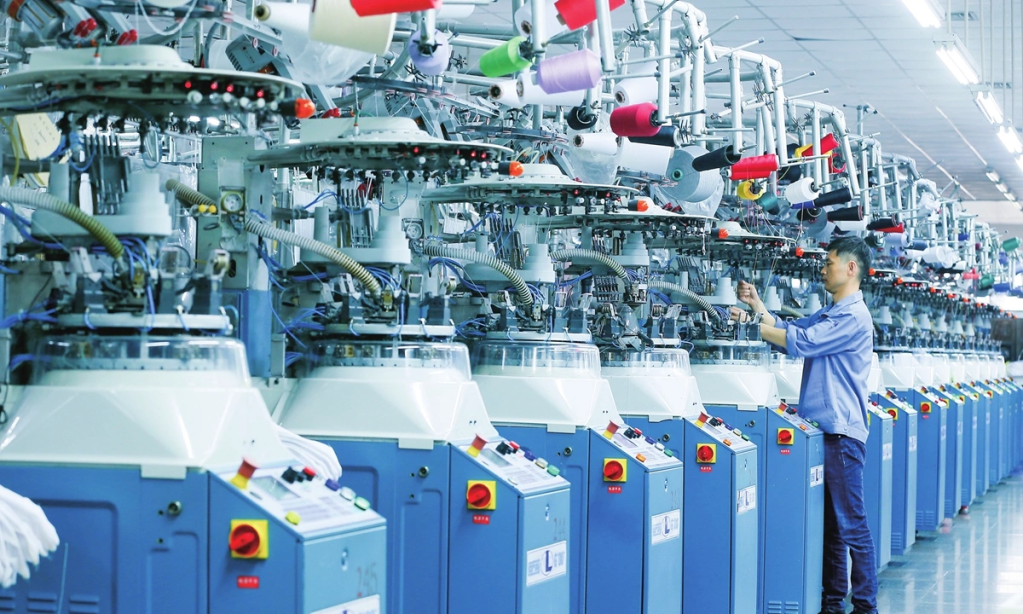

Actually, public data that is well known to anyone involved in international trade, shows that Walmart’s actions are essentially robbery rather than business negotiation. According to statistics from the China National Garment Association, the average profit margin in China’s textile industry in 2024 was only 3.9%. Walmart’s overall 20% price reduction effectively forces Chinese companies to deliver products at a 16.1% loss.

Most people might interpret a 16% loss to mean: “I have invested $1 million and lose $160,000 in a year.” However, this 16% refers to the loss per production cycle. In the textile and apparel industry, the process which starts from purchasing raw materials to the finished product leaving the factory is known as the production cycle. For example, in the apparel and bag categories commonly sold at Walmart, each batch is delivered within 20 to 45 days. If we assume an average of 30 days per cycle, this means there are 12 cycles in a year, leading to an annualized loss rate of 87.66%. By the end of the year, an investment valued at $1 million would be worth less than $130,000.

In China, the more competitive the apparel companies, the higher the automation in their production lines, and the shorter the production cycle. Take China’s best-known Chinese clothing manufacturer, Shenzhou International, who works closely with NIKE, lululemon, and many others. It’s Ningbo factory can achieve delivery in as little as 15 days, which is twice as fast as the international standard. This means that if Chinese companies accept Walmart’s demands, the more competitive they are, the greater their losses—a situation that completely defies market principles.

Retail Insight Network noted that Walmart has a longstanding approach of aggressively minimising purchase costs to sustain its market leadership position, which already pushed Chinese suppliers to operate on razor-thin margins. In fact, any reduction beyond 2% could cause these manufacturers to incur losses. For companies primarily engaged in export trade, fluctuations in exchange rates and changes in payment cycles can significantly affect profit margins. With an original profit margin of only 3.9%, Chinese companies are barely staying afloat—and as the world’s largest retailer, Walmart cannot possibly be unaware of this fact.

CNN points out that many businesses are struggling under Trump’s chaotic tariff announcements, including retailers. However, this criticism essentially serves as a cover-up for Walmart. According to Walmart’s financial report released in February 2025, it has enjoyed a “healthy top line” in fiscal 2025 with its sales, profit and earnings surpassing expectations in the fourth quarter of FY25—with its gross margin rate improved by 53 basis points. It is expected that net sales for fiscal year 2026 will grow at a similar rate of 3% to 4%.

Clearly, Walmart is not in any difficulty; rather, under the guise of an industry downturn, it is pushing Chinese companies into a desperate situation. This unnecessary malice immediately prompted a meeting with the Chinese government, who warned that if Walmart insists on having suppliers cut prices, then what awaits Walmart is not just talk.

Walmart holds no real leverage over China but remains heavily dependent on it. Its 2024 growth was principally driven by Chinese, Mexican and Canadian markets, with Chinese market showing 28% year-over-year sales growth – 7 times its global average.

Moreover, Fox News has pointed out that 60% of Walmart’s supply chain depends on China. This is why, on the 13th of March, the Chinese Ministry of Commerce stated that Walmart’s threats and intimidation would backfire—As the Global Times commented, without Chinese suppliers, more than half of Walmart’s shelves would be empty.

Walmart’s slogan is “Save money, live better.” But while saving money from Chinese suppliers, do American people really live better? According to The Sun, in February 2025, Walmart’s egg prices were raised to $15 per dozen, and American customers are even taking out loans just to afford a bite of an egg.

Now, it appears that platforms like Shein and Temu—which enable American consumers to spend less while protecting Chinese suppliers from extortion—might actually be the ones more deserving of the slogan “Save money, live better.”