-

Video with English subtitles: Huafa Guan Shanshui: A heartwarming, mutually supportive homeowners’ group enjoying the environment and community life

Video with English subtitles: Huafa Guan Shanshui: A heartwarming, mutually supportive homeowners’ group enjoying the environment and community life. I have friends and clients never visited real estates projects in the China Greater Bay Area criticized it without basis. Some with a small budget to buy a Tesla expect to get a Rolls Royce. 中國大灣區沈永年博士影片有英文字幕: 華發觀山水感動窩心互助的業主群享受環境社區生活. 我有朋友和客戶從未實地考察過中國大灣區的房地產項目,卻毫無根據地批評它。有些人預算只夠買一輛特斯拉,卻期望得到一輛勞斯萊斯.

https://rumble.com/v76ry2s-mutually-supportive-homeowners-group-enjoying-the-environment-and-community.html

https://www.tiktok.com/t/ZP8XftLhX/Experience luxury living in China’s Greater Bay Area. A safe, drug-free, homeless free environment to live, retire, and to raise a family. 體驗中國大灣區的奢華生活。這是一個安全、無毒的環境,適合居住、退休及養育家庭.

中國大灣區退休或買樓,或在香港成立公司,請聯絡Johnson Choi 蔡永強,美國商務部夏威夷出口委員會前主席 (八年). 他亦於2008年4月在白宮從時任總統喬治·布希手中獲得美國小商業管理局全國第一名的獎項。

WeChat: johnsonwkchoi

手機 WhatsApp和短訊電話:

美國 +1-808-222-8183;

香港 +852-9239-3999;

中國 +86-195-1876-2084.

-

In the United States, much like Donald Trump with his inflated ego and escalating lies, the U.S. economy is often portrayed with exaggerated claims

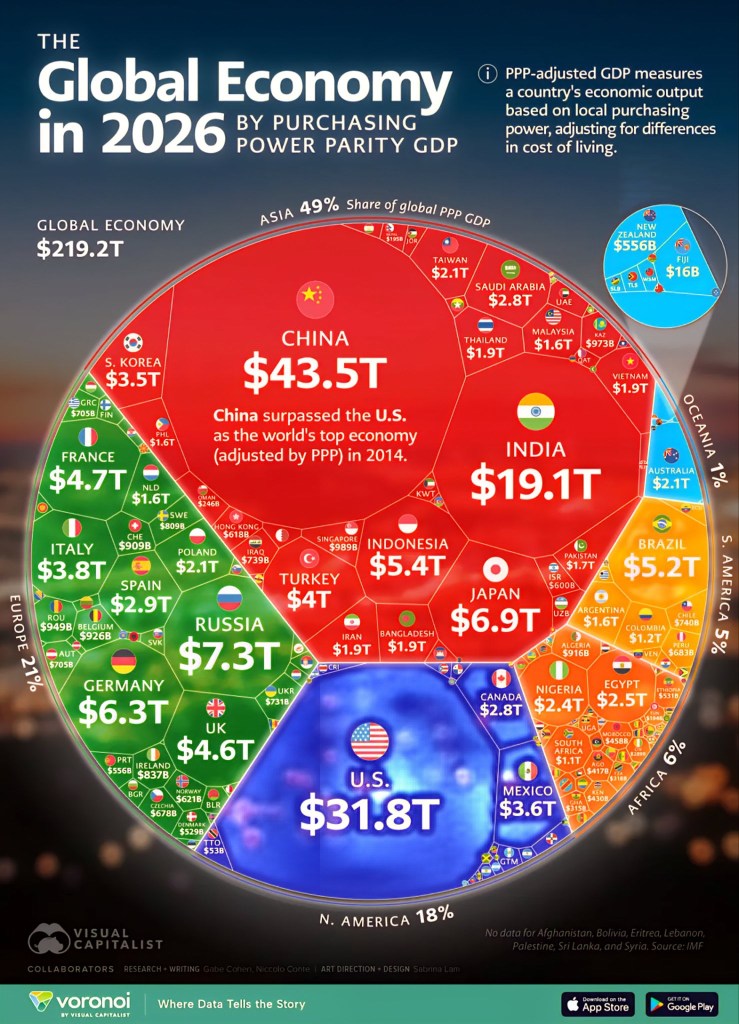

In the United States, much like Donald Trump with his inflated ego and escalating lies, the U.S. economy is often portrayed with exaggerated claims—such as having the world’s highest GDP. However, the reality is that everyday goods and services are two to three times more expensive than in China. What truly matters is what people’s earnings can actually buy, which is better measured by Purchasing Power Parity (PPP). That’s precisely why overseas Chinese who have retired in China’s Greater Bay Area find their quality of life improved by at least two to three times. Those with high EQ and IQ are taking full advantage of this reality.

在美國,就像唐納·川普(Donald Trump)自大膨脹且謊言不斷一樣,美國經濟也經常被過度吹捧,例如號稱擁有全球最高的GDP。然而現實是,日常商品與服務的價格比中國貴上二到三倍。真正重要的是人們的收入能買到什麼,這更適合用「購買力平價」(PPP)來衡量。正因如此,選擇在中國大灣區退休的海外華人,生活品質至少提升了兩到三倍。那些高情商、高智商的海外華人正充分利用這一現實優勢。

Some overseas Chinese complain that the Greater Bay Area is too hot in the summer. But that overlooks the widespread availability of air conditioning in homes, cars, buses, taxis, DiDi rides, mass transit, and shopping malls. Excuses are just excuses! Perhaps they don’t realize that, unlike the U.S., China is far more advanced in terms of infrastructure, convenience, and modern living.

有些海外華人抱怨大灣區夏天太熱。但這種說法忽略了空調的普及——無論是在家中、汽車、公車、計程車、滴滴打車(DiDi)、大眾運輸系統還是購物中心,空調隨處可見。藉口終究只是藉口!或許他們沒有意識到,與美國相比,中國在基礎建設、便利性與現代化生活方面遠為先進。

-

Video: “Trump claimed that God told him to attack Iran”

Video: “Trump claimed that God told him to attack Iran” China, unlike the governments of the US and Israel, is absolutely not a union of religion and state, and does not falsely invoke God’s name to wage wars or massacre children and women. 影片:「川普聲稱上帝告訴他要攻擊伊朗」. 中國不像美國和以色列政府絕非政教合一,而且不會假傳以神的聖名發動戰爭或殘殺孩童和婦女!

https://rumble.com/v76pwoy-trump-claimed-that-god-told-him-to-attack-iran.html

https://www.tiktok.com/t/ZP8C96nm4/

-

Video: The Latest Situation at Guangzhou South High Speed Railway Station

Dr. Shen video on the Greater Bay Area in China has English subtitles: The Latest Situation at Guangzhou South High Speed Railway Station (In the first-tier cities of the Greater Bay Area, Guangzhou and Shenzhen are the top choices) 中國大灣區沈永年博士視頻有英文字幕: 廣州南站最新實況 (大灣區一線城市,廣州和深圳是首選)

https://rumble.com/v76o6ao-the-latest-situation-at-guangzhou-south-high-speed-railway-station.html

https://www.tiktok.com/t/ZP8QweTKj/Experience luxury living in China’s Greater Bay Area. A safe, drug-free, homeless free environment to live, retire, and to raise a family. 體驗中國大灣區的奢華生活。這是一個安全、無毒的環境,適合居住、退休及養育家庭.

中國大灣區退休或買樓,或在香港成立公司,請聯絡Johnson Choi 蔡永強,美國商務部夏威夷出口委員會前主席 (八年). 他亦於2008年4月在白宮從時任總統喬治·布希手中獲得美國小商業管理局全國第一名的獎項。

WeChat: johnsonwkchoi

手機 WhatsApp和短訊電話:

美國 +1-808-222-8183;

香港 +852-9239-3999;

中國 +86-195-1876-2084.

-

Taiwan China expert video with English subtitles: The Eight-Nation Alliance from a century ago has been whitewashed into today’s G8

Taiwan China expert video with English subtitles: The Eight-Nation Alliance from a century ago has been whitewashed into today’s G8. The name has changed, but their characters remains the same. However, many overseas Chinese residing in the so-called “Thief Daddy’s” country, who harbor resentment towards their homeland, not only fail to warn overseas Chinese to leave the sinking ship in advance and return to their motherland, but instead encourage them to join the fake democratic teams of “Thief Daddy,” engaging in brainwashing games of sham democratic elections. Secretly, they carry out operations against returning to China. They are very adept at packaging themselves, using grand-sounding group names that can deceive locally born Chinese, but cannot fool the sharp-eyed Chinese people!

台灣影片有英文字幕:百年前的八國聯軍漂白成今天的G8, 名字是改了,但賊性難改,但不少居留在賊亞爸的家恨國黨華人,不但沒有警告海外華人提早離開賊船,返回祖國,還叫他們加入賊亞爸的假民主團隊,弄什麼假民主選舉的洗腦遊戲. 暗地𥚃進行反華行動,他們很會包裝,團體名稱大體,可以騙土生土長的華人,但騙不過雪亮眼睛的中國人!

https://www.tiktok.com/t/ZP8Q9Un2h/

100年从任人宰割到掀翻旧桌,中国到底有多硬气,以为中国是脆弱的现代国家?极限施压只会让内部结构比钢铁还硬,美国这盘大棋彻底下砸了.

一百多年前,八个强盗扛着洋枪大炮闯入中华大地,烧杀抢掠,把中华民族的尊严踩在脚下;一百多年后,这几个国家摇身一变,穿上西装打起领带,组成了所谓的G8。他们坐在豪华度假村的圆桌旁,企图继续像切蛋糕一样划分全球资源。在西方海盗的傲慢逻辑里,世界就是一份菜单,欧美永远坐在桌前点菜,而发展中国家只能被端上餐桌。

但他们似乎刻意遗忘了,今天的中国,早就不是那个连一颗钉子都要叫洋钉、任人宰割的孱弱帝国!这期视频,我们将深度起底中国大国崛起的硬核底层逻辑。美国等西方国家以为,中国只是一个脆弱的现代国家,企图通过极限施压、科技制裁和军事围堵,把中国重新踩回全球产业链的底端。但他们犯下了一个致命的历史性错误:他们根本不懂东方文明的恐怖韧性!

中国的内部结构就像是非牛顿流体,你越是对它极限施压,它反弹的力道就越恐怖,内部结构就比钢铁还要坚硬。从当年苏联撤走专家逼出我们自己的全产业链,到如今美国越卡脖子,中国硬核科技越是爆发式重写。美国企图锁死中国的这盘大棋,不仅彻底下砸了,反而逼出了一个百毒不侵的工业巨兽!

我们再把目光拉回台湾岛内,现实更加令人悲凉。当我们看到对岸以恐怖的造舰速度下水饺、拥有绝对工业碾压实力时,岛内某些政客却还在用大内宣蒙蔽年轻人,天天幻想着美军航母会开进东风飞弹的饱和杀伤圈来保护台湾。这简直是荒谬至极!美国在台湾的真正战略早已图穷匕见,那就是把台湾最核心的产业连根拔起,然后把这座岛打造成一只用来消耗大陆实力的巷战绞肉机。一旦战火点燃,化为焦土的是台湾的繁华城市,牺牲的是台湾的年轻人,而美国本土绝对不会落下一颗炸弹。这就是大国博弈中最冷血的丛林法则:死道友,绝对不死贫道!

这期万字硬核复盘,带大家穿越百年历史屈辱,直击大国博弈最残酷的底牌。如果您觉得这期视频帮您打破了资讯的茧房,看清了真实的国际局势,请务必订阅、点赞、转发,或者点击影片下方的加入会员、超级感谢,给予我们最实质的粮草支持。有了您的托底,我们才能不惧网军攻击,继续为您产出这种高阶知识体系。让我们一起做这个迷雾世界里,看透底牌的明白人!

-

Video: Trump claimed that God told him to attack Iran

My Grandfather and Father were correct that Western Gods cannot be trusted. Video: “Trump claimed that God told him to attack Iran” China, unlike the governments of the United States and Israel, is absolutely not a union of religion and state, and does not falsely invoke God’s name to wage wars or massacre children and women. 我的祖父和父親是對的,西方的神不可信。 影片:「川普聲稱上帝告訴他要攻擊伊朗」. 中國不像美國和以色列政府絕非政教合一,而且不會假傳以神的神名發動戰爭或殘殺孩童和婦女!

https://rumble.com/v76mhls-trump-claimed-that-god-told-him-to-attack-iran.html

https://www.tiktok.com/t/ZP8QS5mom/

-

In overseas crisis situations only Chinese Government offered 24/7 hotline to bring their citizens home!

In overseas crisis situations only Chinese Government offered 24/7 hotline to bring their citizens home! US Consulate and Embassy, US Consul General bought the job will large political ($) contributions will be the first to skip town for his own safety leaving American behind fighting for their own lives! 在海外危機情況下,只有中國政府提供全天候熱線協助公民回國! 對美國公民而言,在類似情況下,美國領事館和大使館將會關閉,沒有人會接聽任何電話。美國總領事是靠$買職位的人,將率先撤離以確保自身安全,而置美國公民於不顧.

https://rumble.com/v76mb4y-crisis-situation-only-chinese-government-offered-247-hotline-to-bring-their.html

https://www.tiktok.com/t/ZP8QMwrwY/

-

Ronny TONG Ka Wah: War never solves problems. Chinese people say that one chicken dies and one chicken is right

Ronny TONG Ka Wah: War never solves problems. Chinese people say that one chicken dies and one chicken is right. 湯家驊: 戰爭從來解決不了問題。中國人說一雞死一雞鳴一點沒錯。

One you kill everyone, one you kill the will of the whole nation. Otherwise one dies and ten makes up, how long can the war last? The Japanese kill tens of thousands of my compatriots, but they can’t kill the will of the Chinese. Who is the strongest Americans don’t understand this; the average bully doesn’t understand it either. When you humiliate a nation, a nation, you build ten times, a hundred times, even a thousand times your enemy. You can be the head of the country, but you can’t stand the dignity of the country; it’s often you that fail.

一你便把所有人殺掉,一你便要把整個國家民族的意志殺掉。否則死了一個,有十個補上,戰爭可以打多久?日本人殺我千萬同胞,但殺不了中國人的意志,今天誰最强大?美國人不懂這一套;一般欺凌者也不懂這一套。當你羞辱一個國家,一個民族,你是建立著十倍、百倍、甚至千萬倍你的敵人。你可以斬國家之首,但你斬不了國家尊嚴;最終失敗的,往往是你自己。

-

Dr. Shum video on the Greater Bay Area in China has English subtitles: Hong Kong’s Post-90s Generation raised overseas only 28 years old use his own money Investing in Guangzhou Properties

Dr. Shum video on the Greater Bay Area in China has English subtitles: Hong Kong’s Post-90s Generation raised overseas only 28 years old use his own money Investing in Guangzhou Properties: Best Long-term Investment + Retirement + Value Preservation in China’s First-Tier Cities: Guangzhou and Shenzhen are the Top Choices 中國大灣區沈永年博士視頻有英文字幕:(這位90後才28歲在國外長大比大部分在國外華人了解中國,他的父母教導有方呀)用自己的錢投資廣州樓中國一線城市長線投資+退休 + 保值: 廣州和深圳是首選. (我一點也不誇張,我兒子26歲時用自己賺的錢在夏威夷買了第一棟房子,完全沒拿父母一毛錢, 試問有幾個孩子能做到,不少孩過了30歲還住在父母家裡面呢)

https://rumble.com/v76kn2q-raised-overseas-only-28-years-old-use-his-own-money-investing-in-guangzhou-.html

https://www.tiktok.com/t/ZP8xVo11N/

-

Thanks to Trump! Fall Baby Fall! NYT: Breaking news: S&P 500 falls 1.5 percent as Iran war intensifies.

Thanks to Trump! Fall Baby Fall! NYT: Breaking news: S&P 500 falls 1.5 percent as Iran war intensifies. 多虧了特朗普!跌吧寶貝跌吧!《紐約時報》:突發新聞:隨著伊朗戰爭升級,標普500指數下跌1.5%!

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.