A top Wall Street economist is sounding the alarm on sky-high valuations in AI stocks — and drawing comparisons to the tech bubble of the late 1990s. 一位華爾街頂級經濟學家對人工智慧股票的過高估值發出了警告,並將其與 20 世紀 90 年代末的科技泡沫進行了比較.

“Yes, AI will do incredible things for all of us,” Torsten Sløk, chief economist at Apollo Global Management, said on Yahoo Finance’s Opening Bid. “But does that mean I should be buying tech companies at any valuation?”

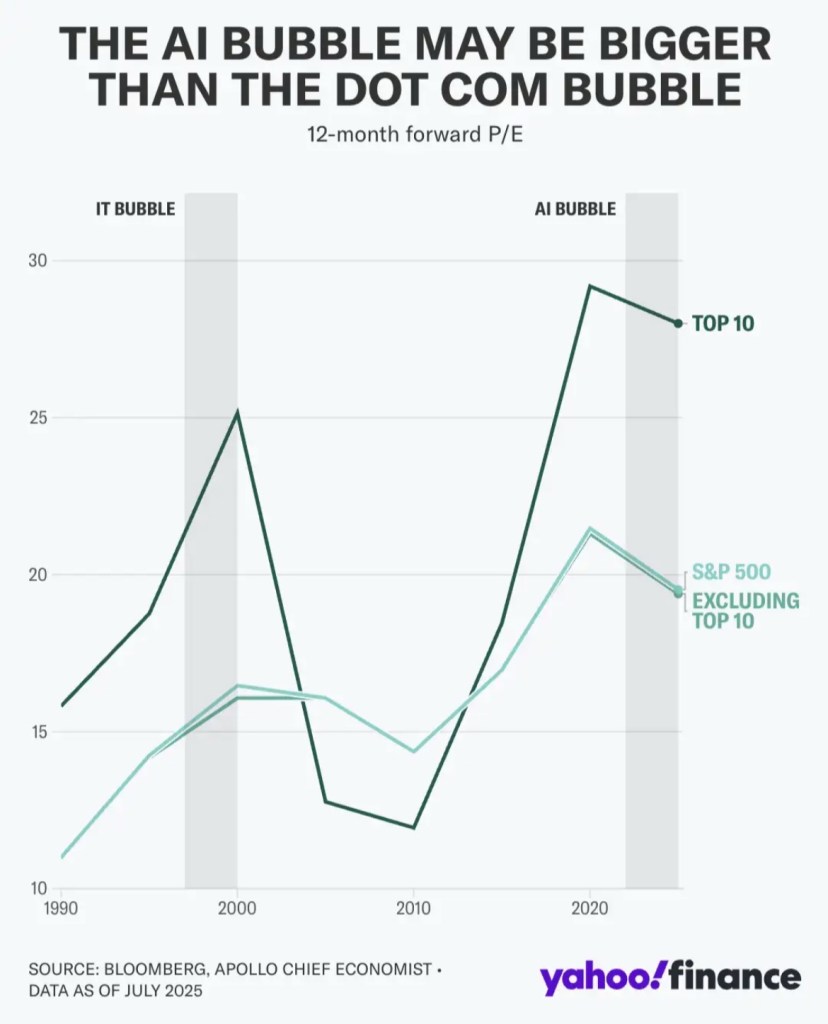

According to Sløk, the answer is increasingly no. In a research note to clients this week, he pointed to internal data showing the price-to-earnings ratios (P/E) of the 10 largest companies in the S&P 500 (^GSPC) — many of them AI stock picks like Meta (META) and Nvidia (NVDA) — have eclipsed P/E levels seen at the height of the dot-com bubble in 1999.

That signals a dangerous concentration of investor exposure in just a handful of tech giants, Sløk argued.

“Almost 40% of the S&P 500 is made up by the 10 largest companies,” he said. “So if I take $100 as an investor and buy the S&P 500, I think I have exposure to 500 different stocks, but I’m really just betting on the Nvidia and the AI story continuing.”