Times have changed — if you don’t open your mouth to ask me for help, I will never take the initiative to hand you the ladder. 今時不同往日,你不開口求我,我絕不主動遞梯子……

The United States and China are now strangely synchronized: while China celebrates its National Day with holidays, the U.S. government is shutting down. It’s as if Washington is waiting for Beijing to rescue the American economy with cash. But this time is not like the last — China has no intention of compromising. So if the U.S. government shuts down, China will not bail it out again.

As the clock struck midnight on October 1, fireworks burst over Beijing’s Tiananmen Square — while the lights went out at the Lincoln Memorial in Washington. The U.S. Treasury’s backend systems stopped right on the second, and 750,000 federal employees received the same email titled “Mandatory Unpaid Furlough.” Even the White House Visitor Center was sealed with yellow tape.

Capitol Hill had been quarreling for 48 hours. Neither party would give in, and the budget bill collapsed. The government simply shut down — for the 24th time since 1976 — but this is the first time the “layoff knife” has been held to civil servants’ throats. Trump announced that if the shutdown lasts more than three days, a “permanent layoff plan” will begin, wiping out 270,000 jobs — one-eighth of the entire federal workforce.

Behind all the drama, the real protagonist is the ledger.

On September 29, the U.S. Treasury’s live debt tracker showed $37.46 trillion in federal debt — rising by $3.5 million per minute. That’s an “invisible mortgage” of $108,000 per American.

For fiscal year 2025 alone, interest payments will consume $1.2 trillion — more than the entire annual defense budget. Yet Congress is still busy throwing chairs over whether to cut Medicare or fund the border wall.

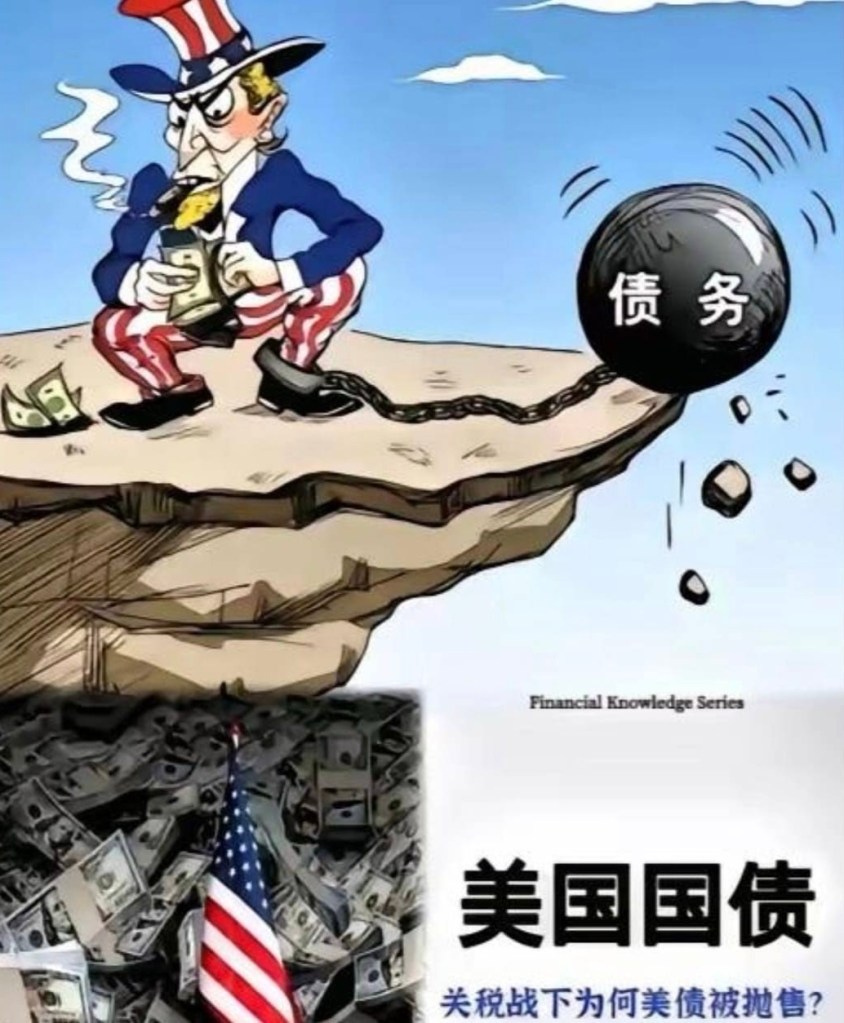

Money’s short, but they can’t cut welfare or defense spending, so they resort to the old trick — raising the debt ceiling. The Senate version proposes another $5 trillion increase, lifting the “credit card limit” to $42 trillion — but no one wants to be the sucker footing the bill anymore.

Ten years ago, as China lit fireworks, it also opened its wallet — a 4 trillion yuan stimulus and massive purchases of U.S. Treasuries, becoming the largest foreign holder of U.S. debt. But the picture has changed: by July this year, China’s holdings had fallen to $730.7 billion, down $25.7 billion since January, and $309.6 billion over ten years — dropping China to the No. 3 position.

Where did the money go?

The People’s Bank of China has been buying gold for ten straight months, ports are importing shiploads of soybeans from Brazil and Argentina, trade with ASEAN is growing by double digits annually, and Belt and Road projects are increasingly settled in renminbi. In short — China is visibly building multiple escape routes for itself.

Meanwhile, U.S. agricultural states are panicking. Secretary of State Marco Rubio even broke precedent by sending Beijing a National Day greeting, and the U.S. Trade Representative’s office leaked that it “looks forward to face-to-face talks” — mocked by foreign media as “even begging must have ceremony.”

In the short term, Uncle Sam won’t collapse overnight. The U.S. dollar still accounts for nearly 60% of global reserves. Wall Street can still attract safe-haven funds from Europe and Japan through high interest rates, and domestic pension funds are being forced to buy more U.S. bonds — barely patching the holes.

But the long-term math doesn’t lie:

Global central banks have added a net 1,200 tons of gold over the past two years — the most in 55 years. France, Saudi Arabia, and Brazil now settle part of their oil and iron ore trades in renminbi or euros, nibbling away at the dollar’s dominance.

Meanwhile, China’s CIPS cross-border payment system has expanded to 160 countries, and offshore renminbi liquidity has surpassed 1.5 trillion yuan. The day no one buys U.S. Treasuries, and America tries to “hand out candy” by printing more money — inflation will have the final say.

The next likely script looks like this:

Congress will pass a short-term seven-week spending bill at the last minute — like putting a bandage on a leaking ship — and delay the debt ceiling fight until after the midterm elections. Trump will use the shutdown to cut “disobedient” departments such as environment, healthcare, and education, saving a few billion in payrolls and blaming Democrats for the chaos.

China will continue gradually trimming its U.S. debt holdings each quarter, replacing them with gold, commodities, and emerging-market local assets — maintaining the rhythm of “if you don’t ask, I won’t offer the ladder.”

Markets will watch the U.S. political circus and raise yields on long-term Treasuries. Once the 10-year rate stabilizes above 5%, the myth of high U.S. stock valuations will be the first to burst — for all the world to see.

Fireworks fade fast, but ledgers don’t lie.

During this Golden Week, 900 million Chinese are traveling and breaking consumption records — and not a single yuan of it is destined for Washington’s debt black hole. The dollar still shines brightly, but the safety net beneath the stage has quietly been pulled away by China.

Now it’s America walking the tightrope — and whether it falls this time depends on whether it can finally cough up that phlegm of deficit on its own.

美國跟中國同步,中國國慶放假,美國政府機構關停,就等中國拿錢救美國經濟,這回可不是上回,中國不打算對美國妥協,所以美國政府關門,中國也不會再救它。

10月1日零點的鐘聲剛響,北京天安門煙花騰空,華盛頓林肯紀念堂卻直接熄燈。美國財政部後台系統掐着秒錶停擺,75萬聯邦僱員郵箱里躺着同一封“強制無薪休假”通知,連白宮遊客中心都貼上黃色封條。

國會山吵了48小時,兩黨誰也沒點頭,預算法案直接爛尾,政府說關就關,這是1976年以來第24回,卻第一次把“裁員刀”架在公務員脖子上:特朗普放話,停擺超三天就啟動“永久裁員”,27萬個崗位直接蒸發,相當於聯邦僱員總數八分之一。

熱鬧背後,賬本上那串數字才是主角。美國財政部9月29日自己掛出的實時表:聯邦債務37.46萬億美元,每分鐘再漲350萬美元,攤到每個美國人頭上就是10.8萬美元“隱形房貸”。光2025財年利息就要燒掉1.2萬億美元,比全年軍費還高,國會還在為誰砍醫保、誰保邊境牆互扔椅子。

錢不夠,又不能停福利、降軍費,只能老套路——抬債務上限。參議院版本一口氣往上加5萬億,把“信用卡額度”撐到42萬億,可沒人願意再當冤大頭買單。

十年前,中國一邊放煙花一邊掏錢包,四萬億刺激外加連續增持美債,成了美債最大海外接盤俠。現在畫風變了:今年7月中國持倉掉到7307億美元,比年初再減257億,十年裡累計拋出3096億美債,倉位直接降到老三。

賣債的錢幹嘛?央行連續十個月囤黃金,港口從巴西、阿根廷整船整船拉大豆,東盟貿易額年年兩位數漲,“一帶一路”項目用人民幣結算一筆接一筆,肉眼可見給自己多留幾條後路。美國農業州急得跳腳,國務卿魯比奧破天荒在國慶期間給北京發賀電,貿易代表辦公室放風“期待面對面”,被外媒調侃“要飯也要講儀式感”。

短期看,山姆大叔還不會瞬間斷氣。美元儲備佔比仍接近六成,華爾街還能靠高利率從歐洲、日本吸來避險資金,國內養老基金被迫加倉本國債券,勉強把窟窿糊住。

可長期算盤噼啪響:全球央行過去兩年凈增持黃金1200噸,創55年新高,法國、沙特、巴西把部分原油、鐵礦石合同改成人民幣或歐元結算,美元份額被一點點啃走。中國這邊把CIPS跨境支付系統擴到160個國家,離岸人民幣流動性池子已超1.5萬億,真到哪天美債沒人接,美國還想靠印鈔機發糖,就得先問問通脹答不答應。

接下來的劇本大概率是這樣:國會拖到最後時刻通過一份短命的七周臨時撥款,像給漏水的船貼創可貼,債務上限拖到明年中期選舉后再說;特朗普借裁員砍掉“不聽話”的環保、醫療、教育部門,省出幾百億工資支出,把矛盾往民主黨身上甩。

中國則繼續按季度小幅減持美債,用黃金、大宗商品、新興市場本幣資產填外匯儲備,保持“你不開口求我,我絕不主動遞梯子”的節奏。市場一邊看美國政治脫口秀,一邊給長期美債利率加價,十年期收益率一旦站穩5%上方,美股高估值神話就先崩給世界看。

煙花易冷,賬本難賴。北京這個黃金周9億人次出遊、消費破紀錄的喧鬧聲里,沒有一分錢打算去華盛頓的債務黑洞里填坑。美元依舊耀眼,但舞台中央的安全網已被中國悄悄抽走;再走鋼絲的是美國自己,這回摔不摔,全看它能不能自己把赤字這口老痰咳出來。