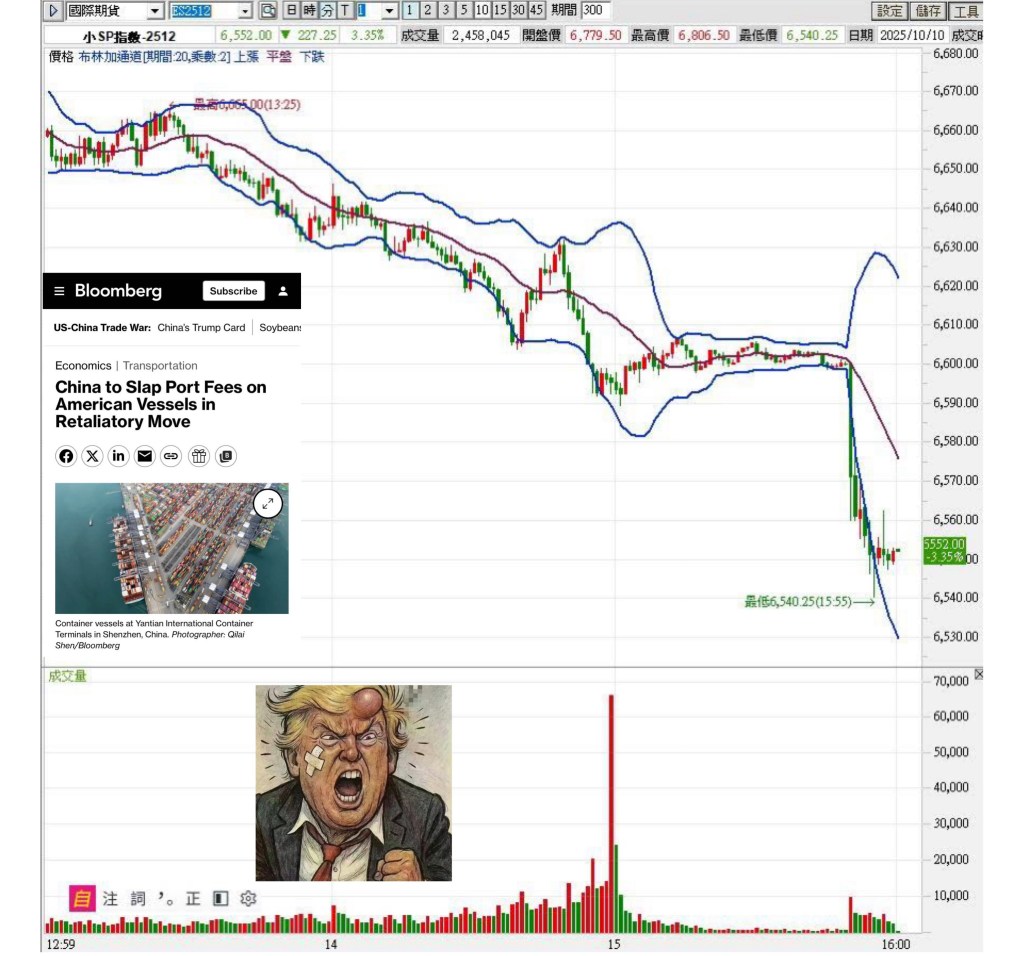

Trump is furious! He’s slapping 100% tariffs on China and implementing export controls on all critical software starting November 1st. The US-China trade war has intensified, sending US stocks tumbling! 川普发飙!加征中国100%关税,并从11 月 1 日起,对所有关键软件实施出口管制。美中贸易战杀得上头了,搞得美股跳水!

China announced an antitrust investigation into Qualcomm for its acquisition of Autotalks. It also announced a further antitrust investigation into Nvidia, accusing Nvidia of violating antitrust laws and restrictive conditions imposed during its acquisition of Mellanox. Furthermore, China will impose special port fees on ships containing US elements, such as those flagged, US-built, owned, invested in, or operated by US companies. These measures will take effect on October 14th, simultaneously with the US imposition of port fees on Chinese vessels.

Previously, China’s Ministry of Commerce, in conjunction with the General Administration of Customs, issued an announcement regarding export controls on superhard materials, rare earth equipment and raw materials, five types of medium and heavy rare earths, including holmium, and related items for lithium batteries and artificial graphite anode materials. These measures will take effect on November 8th.

China’s series of heavy-handed punches, coupled with a backhanded punch, has already caused Trump to wonder if the APEC meeting at the end of the month will take place. Because even if it does, there’s nothing to discuss, so what’s the point?

Previously, the Office of the United States Trade Representative announced the final measures in its Section 301 investigation into China’s maritime, logistics, and shipbuilding sectors. Effective October 14th, port service fees will be increased for vessels owned or operated by Chinese companies, ships built in China, and ships with Chinese flags.

The two sides are trading blows, one for the other. The stock market has become the victim. Furthermore, China National Mineral Resources Group has signed an agreement with Australian mining giant BHP Billiton to settle iron ore spot trades in RMB starting in the fourth quarter of this year. This move breaks the traditional practice of settling bulk commodities in US dollars, giving China pricing power and driving down prices.

Although BHP Billiton is an Australian company, it’s actually a US capital base. China’s stance not only challenges the dollar’s status but also directly strikes a blow against US capital.

BHP Billiton sells 40% of its production to China, and ultimately had to concede. But how could the US not retaliate? There is no end in sight to the US-China tussle.

中方宣布对高通进行反垄断调查,因高通公司收购Autotalks。同时宣布,对辉达宽实施进一步反垄断调查,指控辉达违反反垄断法及此前收购迈络思时设定的限制性条件。另外,中方对涉及美国旗、美国造、美国公司拥有、参股或经营等美国元素的船舶收取特别港务费。相关措施将于10月14日,美方针对中国相关船舶征收港口费的措施实施同时正式实施。

此前,中国商务部会同海关总署发布关于对超硬材料、稀土设备和原辅料、钬等5种中重稀土、锂电池和人造石墨负极材料相关物项实施出口管制措施的公告,将于11月8日正式实施。

中方一连串重手拳,加后手拳,已打得川普称月底APEC亚太经合会不会了?因为会了也没啥好谈,会什么会!

先前,美国贸易代表署宣布了对中国海事、物流和造船领域301调查最终措施,10月14日起,对中国公司拥有或运营的船舶、中国造船舶、中国籍船舶加收港口服务费。

你来我往,你一拳我一腿。股市成祭品。还有,中国矿产资源集团已经和澳洲矿业巨头必和必拓签署协议,今年第四季起铁矿石现货贸易以人民币结算。此举打破了大宗物资以美元结算的常规,为中方拿下铁矿石定价权并压低价格。

必和必拓虽名为澳商,但实为美国资本地盘,中方的立场不但挑战美元地位,但直接打击美国资本。

必和必拓百分之四十的产量全卖往中国,最终也不得不低头。但美国岂能不反击?美中角力看不到尽头。