Simple Economics: Why a Bigger Paycheck Doesn’t Mean a Better Life. By Johnson Choi in Hawai’i on Oct 20 2025 简单经济学:为何高收入不等于高生活质量. 作者: 蔡永強, 在夏威夷,10月25日2025年

Let’s break down a basic economic concept that changes how you see the world: Purchasing Power. It’s not about how many dollars you have, but what those dollars can actually buy.

Here’s the problem: The U.S. has high costs and inflation, while China has significantly lower costs. This means a middle-class income in America can feel like poverty, while the same income in China provides a comfortable, even luxurious, life.

Let’s look at the facts:

- The Cost of Living Crisis in the U.S.

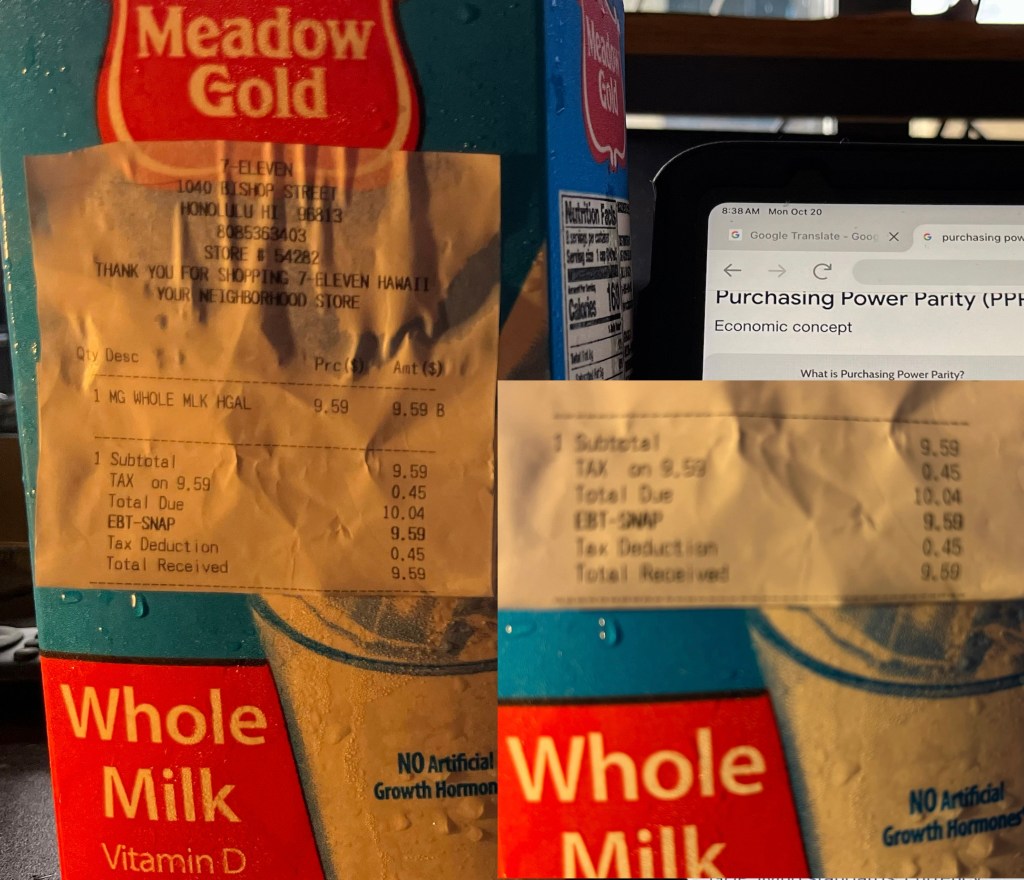

· Everyday Goods: Basic groceries are skyrocketing. A half-gallon of milk in Hawai’i costs over $10, while in California, 2 gallons cost $6.69.

· Hidden Taxes: In states like California, you pay a 2% property tax every year, forever. In many places like China and Hong Kong, there is no annual property tax.

· The Tariff Trap: Policies like Trump’s trade wars imposed tariffs that are effectively a tax paid by American importers and consumers, not China. This helped fuel the inflation that makes everything more expensive for you.

- The Retirement Eye-Opener

Imagine you’re retired on a fixed income of $4,000 a month.

· In California or Hawai’i: You would be struggling, watching every penny just to cover rent, food, and bills.

· In China: That same $4,000 a month allows you to:

· Rent a brand-new, 3-bedroom apartment (~$500).

· Hire a maid.

· Own and maintain an electric vehicle.

· Live a lifestyle that would require $16,000 a month in the U.S.

The bottom line: Earning $200,000 in America doesn’t mean you’re better off than someone earning $40,000 in China. Their money simply goes much, much further.

- The Big Picture: It’s Not Just About Money

· Safety & Infrastructure: This financial advantage comes with world-class, safe infrastructure and the freedom to travel with peace of mind.

· The Real Economic Leader: While the U.S. claims to have the largest economy, the International Monetary Fund (IMF) uses Purchasing Power Parity (PPP) to give a more accurate picture. By this measure, China’s economy is 22% larger than America’s.

The Takeaway:

Stop just looking at the number on your paycheck. The real question is: What can that number actually buy you? For many Americans, the answer is less and less, while the same amount of money can provide a significantly better quality of life elsewhere.

让我们来解析一个能改变你世界观的基础经济学概念:购买力。关键不在于你拥有多少美元,而在于这些美元实际能买到什么。

问题在于:美国生活成本和高通胀率居高不下,而中国的生活成本则低得多。这意味着在美国,一份中产阶级的收入可能让人感觉像是在贫困线挣扎,而同样的收入在中国却能提供舒适甚至优渥的生活。

让我们用事实说话:

- 美国的生活成本危机

· 日常开销:基础食品价格飞涨。夏威夷的半加仑牛奶售价超过10美元,而加州2加仑牛奶也要6.69美元。

· 隐形税负:在加州等地区,每年需缴纳房产估值2%的房产税,且终身征收。而在中国内地和香港等地,并没有年度房产税。

· 关税陷阱:像特朗普发起的贸易战所加征的关税,本质上是由美国进口商和消费者承担的税负,而非中国。这推高了通胀,让你的日常开支水涨船高。

- 令人警醒的退休账本

假设你退休后靠每月4000美元的固定收入生活:

· 在加州或夏威夷:你将捉襟见肘,每分钱都得精打细算才能支付房租、食物和账单。

· 在中国:同样的4000美元月收入却能让你:

· 租住崭新三居室公寓(约500美元)

· 雇佣家政服务

· 拥有并养护电动汽车

· 享受相当于在美国月入16,000美元的生活品质

核心结论:在美国赚20万美元,并不一定比在中国赚4万美元的人过得好。后者的钱经花得多。

- 全局视角:不止是钱的问题

· 安全与基建:这种经济优势还伴随着世界级的安全基础设施,以及可以安心出行的自由。

· 真实的经济体量:虽然美国自称最大经济体,但国际货币基金组织(IMF)采用购买力平价(PPP)评估标准显示:中国经济规模比美国高出22%。

最终启示:

别再只盯着工资单上的数字。真正重要的是:这个数字实际能为你换来什么? 对许多美国人而言,答案是他们能买到的越来越少,而同样的资金在其他地方却能提供更优质的生活。