Video: Why Billionaires Are Selling Everything Right Now (They See What You Don’t) Just like they did in 2007 & 2008 leading to World Financial Crisis 影片標題:為何億萬富豪正在拋售一切(他們看到了你未見的徵兆)- 正如他們在2007至2008年金融危機前的操作

https://rumble.com/v72e2oo-billionaires-are-selling-everything-now-they-see-what-you-dont-just-like-th.html

https://www.tiktok.com/t/ZP8UPaw6f/

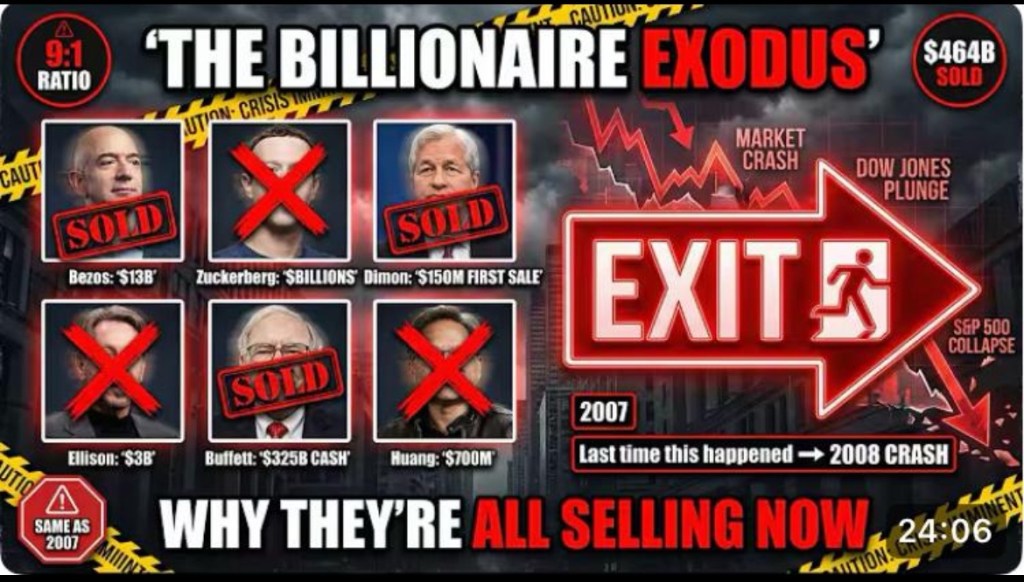

Jeff Bezos: Sold $13 billion in Amazon stock.

Mark Zuckerberg: Sold billions in Meta shares.

Jamie Dimon: Sold stock for the FIRST TIME EVER as JPMorgan CEO.

Larry Ellison: Sold $3 billion in Oracle.

The Walton Family: Sold $2 billion in Walmart.

Nvidia Insiders: Sold $700 million while stock hit all-time highs.

This isn’t diversification. This isn’t tax planning. This is an EXODUS.

THE LARGEST COORDINATED INSIDER SELLING SINCE 2007.

And we all know what happened in 2008.

THE NUMBERS:

Total Insider Selling (2024): $464 BILLION

Second-highest year on record

Highest was 2007: $650 billion

2008: Financial crisis, S&P fell 57%

Sell-to-Buy Ratio: 9:1

Normal ratio: 3:1 (healthy market)

2024 ratio: 9:1 (insiders selling $9 for every $1 bought)

Some months: 12:1 (extreme panic selling)

Most extreme ratio in recorded history

THIS IS NOT NORMAL DIVERSIFICATION. THIS IS SYSTEMATIC EXIT.

WHO’S SELLING (THE EVIDENCE):

JEFF BEZOS – $13 BILLION:

February 2024: Filed to sell 50M shares ($8.5B)

July 2024: Filed to sell 25M more shares ($4B+)

Total 2024: Over $13 billion in Amazon stock

Official reason: “Moved to Florida for tax benefits”

Real reason: Selling at all-time highs before crash

Why this matters:

Bezos founded Amazon, knows it better than anyone

Worth $200B+, doesn’t need the money

Could have moved to Florida anytime in 25 years

Chose to sell $13B in 2024 specifically

Timing = market at peak

MARK ZUCKERBERG – BILLIONS:

Sold hundreds of millions of Meta shares in 2024

Meta stock hit $500+ (all-time highs)

Largest sales ever as % of holdings

Official reason: “Funding Chan Zuckerberg Initiative”

Real reason: Selling at peak before crash

Why this matters:

Zuckerberg created Meta, controls it through super-voting shares

Worth $180B+, could fund philanthropy anytime

Chose 2024 when stock hit records

That’s market timing, not philanthropy

JAMIE DIMON – $150 MILLION (MOST IMPORTANT SIGNAL):

CEO of JPMorgan Chase since 2005 (19 years)

NEVER sold a single share in 19 years

Preached long-term holding to investors

2024: Sold 1M shares ($150M) FOR THE FIRST TIME EVER

Official reason: “Estate planning and diversification”

Why this is THE signal:

19 years, zero sales, then suddenly sells

Could have done “estate planning” anytime

Chose 2024 at market all-time highs

As CEO of largest US bank, sees data nobody else does:

Loan defaults rising

Commercial real estate collapsing

Consumer credit maxing out

This isn’t estate planning, this is the ultimate insider warning

傑夫·貝佐斯:拋售130億美元亞馬遜股票

馬克·扎克伯格:拋售數十億美元Meta持股

傑米·戴蒙:擔任摩根大通CEO以來首度拋股

拉里·埃里森:拋售30億美元甲骨文股票

沃爾頓家族:拋售20億美元沃爾瑪股份

英偉達內部人士:趁股價創新高拋售7億美元

這不是資產分散配置,也不是稅務規劃

而是一場資本大遷徙

自2007年以來最大規模的內部人士協同拋售

而我們都見證過2008年的結局

關鍵數據:

2024年內部人士總拋售額:4640億美元

創歷史第二高紀錄

最高紀錄是2007年:6500億美元

2008年:金融危機爆發,標普500指數暴跌57%

售買比率達9:1

正常市場比率為3:1

2024年比率意味著每買入1美元即拋售9美元

部分月份甚至達到12:1(極度恐慌性拋售)

創有史以來最極端紀錄

這絕非常態資產配置,而是系統性撤離

拋售者實證分析:

傑夫·貝佐斯—130億美元:

2024年2月:申請拋售5000萬股(85億美元)

2024年7月:再申請拋售2500萬股(逾40億美元)

官方說詞:「為佛州稅務優惠搬遷」

實情:在市場崩盤前於歷史高點出脫

關鍵意義:

創辦人最洞悉企業真實價值

身價逾2000億無資金需求

25年間隨時可遷居佛州

獨選2024年集中拋售

時機指向市場頂點

馬克·扎克伯格—數十億美元:

2024年拋售數億股Meta持股

股價突破500美元歷史高點

持股比例降幅創個人紀錄

官方說詞:「資助陳-扎克伯格計劃」

實情:在峰值提前套現

關鍵意義:

透過超級投票權絕對控股

身價1800億卻選在股價巔峰套現

實為市場時機操作而非公益需求

傑米·戴蒙—1.5億美元(最關鍵信號):

執掌摩根大通19年從未拋股

始終向投資者倡導長期持有

2024年破天荒出售100萬股

官方說詞:「遺產規劃與資產分散」

終極警訊解讀:

19年零拋售後突襲出脫

遺產規劃本可隨時進行

獨選市場巔峰時出手

作為全美最大銀行CEO掌握獨家數據:

違約率攀升

商業地產崩潰

消費者信貸觸頂

這非遺產規劃,而是終極內部預警