International Monetary Fund Official Announcement: China’s Purchasing Power Parity (PPP) GDP at $43.49 Trillion, Leading the U.S. by $13 Trillion… 国际货币基金组织官宣:中國購買力平價(PPP) GDP43.49萬億,領先美國13萬億…

Recently, a figure in a report by the International Monetary Fund (IMF) is quietly rewriting the global economic rankings: measured by purchasing power parity (PPP), China’s GDP reached 290 trillion yuan, while the U.S. stood at 217 trillion yuan—a difference of 71 trillion yuan in China’s favor. But strangely, this doesn’t seem to have caused much of a stir, as most people are still focused on another number: measured by exchange rates, China’s GDP is only about 70% of that of the United States.

It’s like two completely different rulers measuring two entirely different “world number ones.” So the question arises: which ruler measures the real world? A cup of coffee selling for over ten yuan in Beijing and another selling for five or six dollars in New York—what economic truth lies behind them?

Don’t you also find it puzzling? On the same planet, how can there be two ways to measure economic size? On one hand, the exchange rate method converts each country’s GDP into U.S. dollars at current exchange rates for comparison. On the other hand, purchasing power parity (PPP) disregards exchange rate fluctuations and focuses only on how much real goods and services the same amount of money can buy in different countries. The difference is substantial.

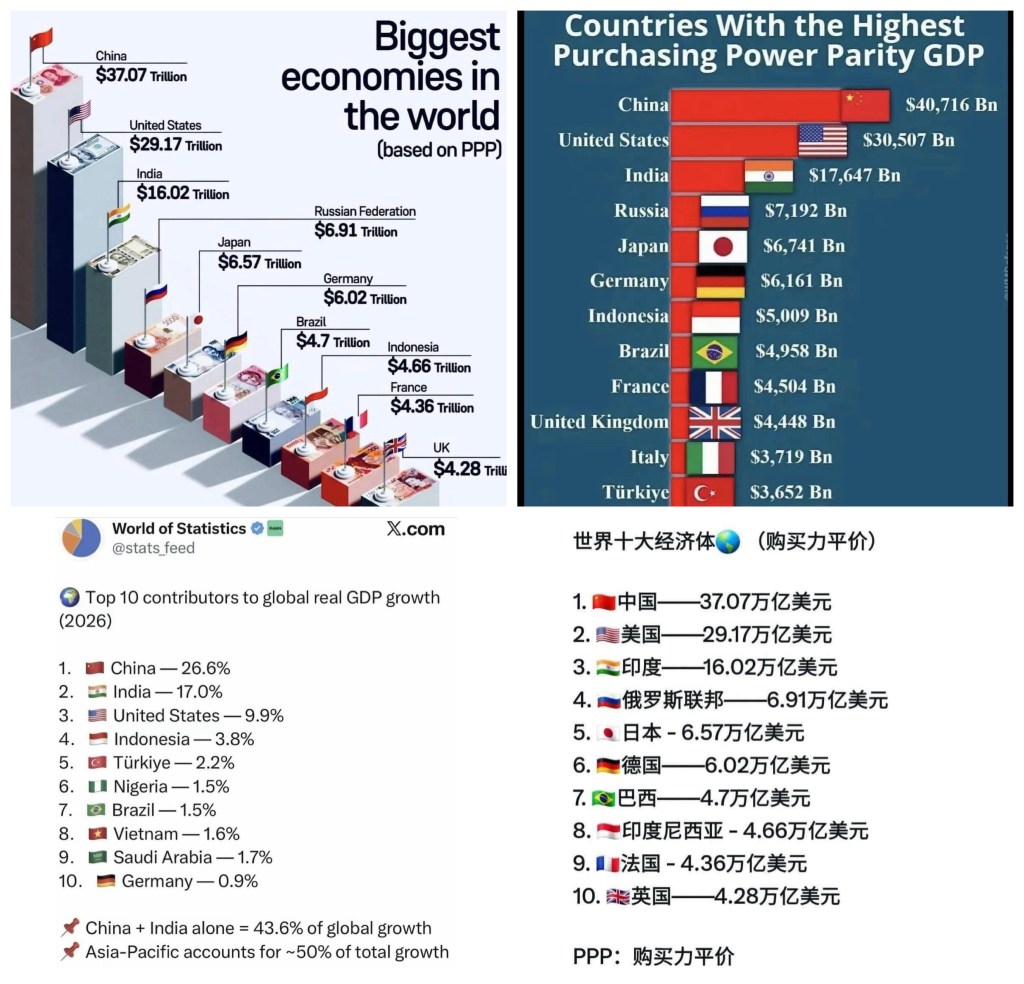

Take the 2025 data, for example. By the exchange rate method, U.S. GDP is $30.5 trillion, while China’s is $19.2 trillion, roughly 63% of the U.S. figure. This is a picture we’ve seen for many years, almost becoming a kind of “common sense.” But if we switch rulers and use PPP calculations, the picture flips instantly: China’s PPP-adjusted GDP reaches $43.1 trillion, while the U.S. stands at around $30 trillion.

The IMF’s more specific forecast indicates that China’s PPP GDP is approximately $40.72 trillion (about 290 trillion yuan), while the U.S. is about $30.5 trillion (around 217 trillion yuan), putting China ahead by 71 trillion yuan. This means that if measured by purchasing power, China’s economic size had already surpassed that of the United States in 2014.

Why do the two measurement methods yield such vastly different results? The core lies in exchange rate fluctuations and price levels. Over the past few years, the Federal Reserve’s consecutive interest rate hikes strengthened the U.S. dollar, leading to a relative depreciation of the Chinese yuan. This directly lowered the dollar-denominated size of China’s economy. At the same time, the U.S. experienced higher inflation, with rising prices boosting its nominal GDP figures.

The PPP method, however, attempts to strip away these interferences by asking a more fundamental question: For instance, if a McDonald’s Big Mac sells for 19.8 yuan in Beijing and $4.79 in New York, does the burger in Beijing truly represent less economic value than the one in New York? Clearly not—the same bread, beef, and sauce create similar value. The exchange rate method measures the “appearance” of money, while PPP measures the “substance” of how many tangible goods can be purchased.

最近,國際貨幣基金組織(IMF)一份報告里的一個數字,正在悄悄改寫全球經濟的排名表:按購買力平價(PPP)計算,中國的GDP達到了290萬億元人民幣,而美國是217萬億元人民幣,中國足足多了71萬億元。 但奇怪的是,這事兒好像沒掀起太大波瀾,因為大多數人還在盯着另一個數字:按匯率算,中國GDP只有美國的七成左右。

這就像兩把完全不同的尺子,量出了兩個截然不同的“世界第一”。 那麼問題來了,到底哪把尺子量的才是真實的世界? 一杯在北京賣十幾塊人民幣的咖啡,和一杯在紐約賣五六美元的咖啡,背後到底藏着怎樣的經濟真相?

你是不是也覺得納悶,同一個地球,怎麼衡量經濟大小還能有兩套說法? 一邊是匯率法,把各國GDP按當前匯率換成美元來比大小;另一邊是購買力平價(PPP),它不管匯率怎麼波動,只關心同樣一筆錢,在不同國家到底能買到多少實實在在的東西。 這區別可大了去了。

就拿2025年的數據來說,按匯率法,美國GDP是30.5萬億美元,中國是19.2萬億美元,中國大約是美國的63%。 這個畫面我們看了很多年,似乎成了某種“常識”。 但如果我們換把尺子,用PPP來計算,畫面瞬間翻轉:中國的PPP GDP達到了43.1萬億美元,而美國則在30萬億美元左右。

國際貨幣基金組織(IMF)更具體的預測是,中國PPP GDP約為40.72萬億美元(約290萬億元人民幣),美國約30.5萬億美元(約217萬億元人民幣),中國領先了71萬億元人民幣。 這意味着,如果用購買力這把尺子,中國的經濟規模在2014年就已經超過了美國。

為什麼兩把尺子量的結果天差地別? 核心就在於匯率波動和物價水平。 過去幾年,美聯儲連續加息,美元走強,人民幣相對貶值,這直接壓低了用美元計算的中國經濟規模。 同時,美國經歷了較高的通脹,物價上漲推高了其名義GDP的數字。

但PPP方法試圖剔除這些干擾,它問的是一個更本質的問題:比如,一個麥當奴的巨無霸漢堡在北京賣19.8元,在紐約賣4.79美元,難道北京那個漢堡所代表的經濟價值就真的比紐約的低嗎? 顯然不是,同樣的麵包、牛肉、醬料,創造的價值是相近的。 匯率法量的是錢的“面子”,而PPP量的才是能買到多少實物的“裡子”。