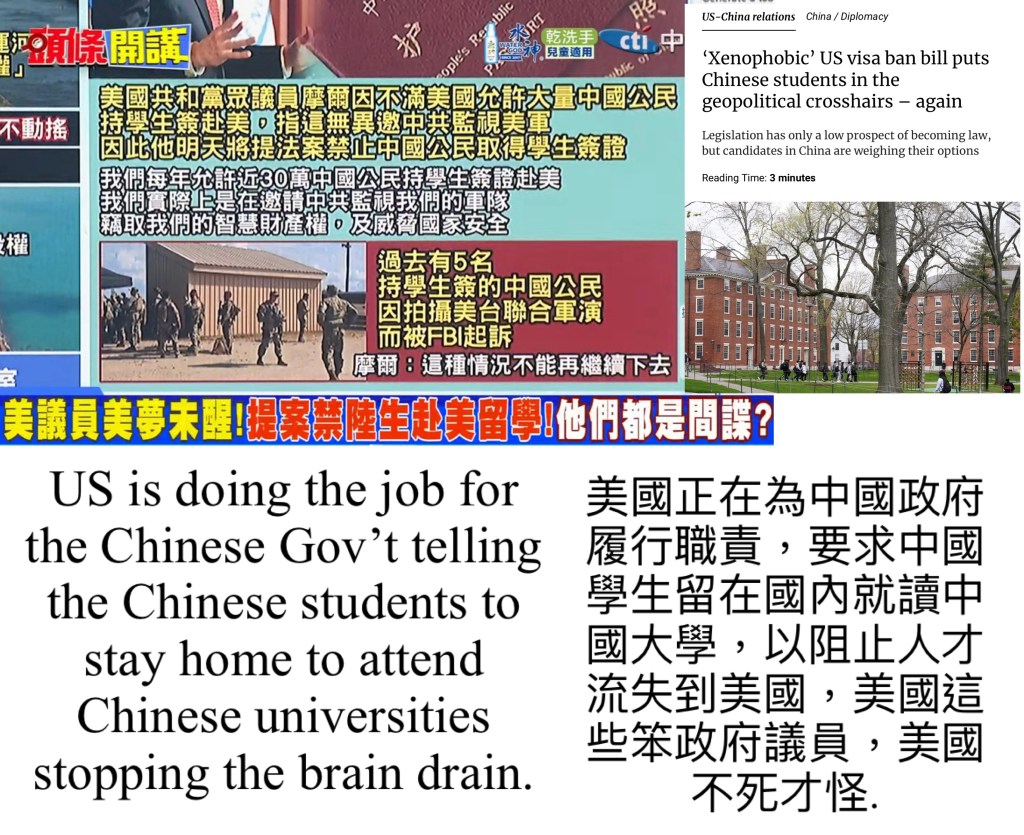

US is doing the job for the Chinese Gov’t telling the Chinese students to stay home to attend Chinese universities stopping the brain drain. 美國正在為中國政府履行職責,要求中國學生留在國內就讀中國大學,以阻止人才流失到美國,美國這些笨政府議員,美國不死才怪.

US is doing the job for the Chinese Gov’t telling the Chinese students to stay home to attend Chinese universities stopping the brain drain. 美國正在為中國政府履行職責,要求中國學生留在國內就讀中國大學,以阻止人才流失到美國,美國這些笨政府議員,美國不死才怪.

Why can only Chinese civilization rise again? It will never decline! 為什麼只有中華文明可以再度崛起? 永不沒落.

The ideological background of the Chinese people: Other civilizations emphasize individual rights, but China emphasizes the equivalence of “rights” and “obligations.” The emperor has the right, but must also have obligations; the official has the right, but must also serve the country and the people with all his life; you are a father, a son, a husband, and a wife, and each status is tied with corresponding responsibilities. This set of logic has been engraved in the bones from generation to generation and has become a cultural gene. Therefore, every time China declines, someone always stands up and says that this land cannot just end like this, and I have to do something. This “sense of civilizational renaissance” is China’s real trump card 中國人的思想底色:別的文明講個人權利,中國講 “權利”和“義務” 對等。皇帝有權,也必須有義務;當官的有權,也得死命為國為民;你是爹,是兒,是夫,是妻,每個身份都捆着對應的責任。這套邏輯一代代刻進骨子裡,成了文化基因。所以,每次中國衰落,總有人站出來,說這片土地不能就這麼完了,我得做點什麼。這種“文明復興感”,才是中國真正的底牌。

前兩年,我有個美國朋友來中國小住了一段時間。平時我們聊天,他總是好奇,問我:中國歷史上王朝更迭那麼頻繁,怎麼每次改朝換代之後,這個國家又能重新振作起來?

按他們的理解,統治階層被推翻,精英消失,社會應該要亂幾十年,甚至分裂重組。但中國不同,每次好像都沒太大事兒,換個朝代接着干,而且還能越來越大、越來越強。

我說,你們看中國歷史,老盯着皇帝換誰當了、朝代名叫什麼,其實這都不重要。中國歷史真正牛的地方,是這片土地三五百年就洗一次牌。

老百姓推翻朝廷,上去一撥新的;新的再腐化墮落,老百姓又翻回來。這一上一下,你們以為是動亂,其實是中國最獨特的社會基因:上下搖勻。

中國不是西方那種精英階層代代壟斷,也不是印度那種種姓固化,咱這兒是寒門也能出貴子,貴子掉下來還得種地。你往上數三代,誰家祖墳里都有官;你往下挖三代,哪個名門望族裡也有叫花子。

這個反覆折騰,折騰出了全世界獨一份的事兒:中國不怕精英團滅,因為人才永遠散落在大地上,埋在泥里,隨時能撈出來接班。更狠的是,新中國把這個模式做到了極致。

義務教育鋪開,縣中、村小、重點高中一條龍,寒門孩子照樣考清北,一縣裡就能湊齊打天下的班底。這不是偶然,這是歷史規律在現代制度里的延續!過去是村口私塾里走出來個狀元,現在是鎮上中學里殺出來個狀元,邏輯沒變。

更重要的,是中國人的思想底色:別的文明講個人權利,中國講 “權利”和“義務” 對等。皇帝有權,也必須有義務;當官的有權,也得死命為國為民;你是爹,是兒,是夫,是妻,每個身份都捆着對應的責任。這套邏輯一代代刻進骨子裡,成了文化基因。

所以,每次中國衰落,總有人站出來,說這片土地不能就這麼完了,我得做點什麼。這種“文明復興感”,才是中國真正的底牌。

別的國家崩了是換地圖,中國崩了是換朝代,但文化一直沒散。每次摔倒,地上那撥人站起來,拍拍土,接着往前走。因為他們知道,這片土地不屬於某個皇帝、某個家族,而屬於所有紮根在這裡的人。

這,就是為什麼中國是唯一一個能千年不滅、還能反覆崛起的文明。因為真正的權力,從來不在廟堂,也不在宮殿,而是在無數普通人心裡,代代相傳,刻在骨頭裡,永遠不會斷。

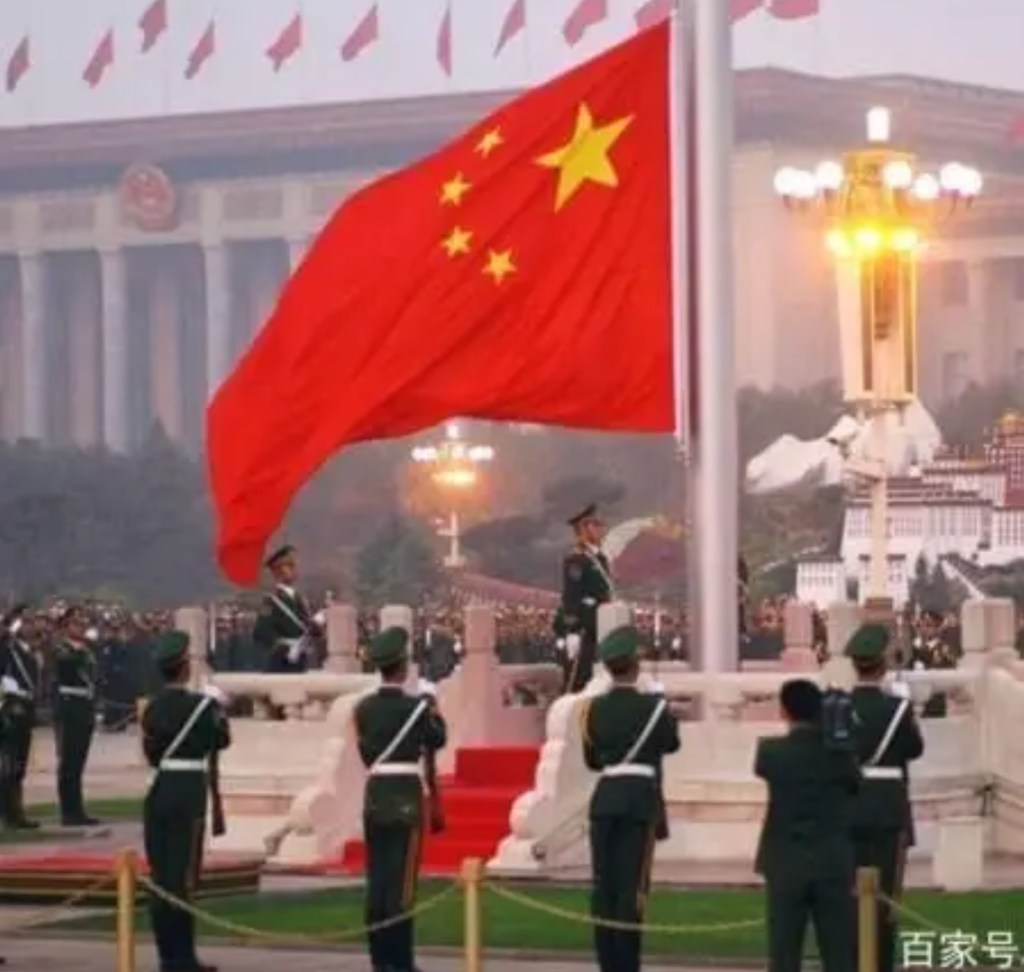

SCMP: We need one in Hawaii and SF when we are forced to pay 30% tax and tips cost us 10x more than China! A fully automated noodle shop in southeastern China serves a bowl of noodles in just 48 seconds, starting at 9.9 yuan (US$1.4) per bowl with no tip or tax required. 香港南華早報: 當我們被迫在夏威夷和舊金山繳納30%的稅並且小費是中國的10 倍價錢時,我們在夏威夷和舊金山就需要一個!中國東南部的一家全自動麵館僅需 48 秒就能煮好一碗麵,每碗麵起價 9.9 元(1.4 美元),無需小費或稅🇨🇳👌 在美國表面風光,以為賺到很多錢,但美國東西比中國貴5-7倍,所以中國人在中國的平均生活水準比美國的華人活得更快樂自由! 當然有些從來不回國的華人是一無所知,東升西降早巳經成為定局!

「我命由我不由天」 你知是誰說的嗎?我完全同意這個講法!我的命運是掌握在我手裡,一定不是美國政府, 也一定不是我的兒孫.

UK PRESS RELAUNCHES ‘WMD’ SCAM: Weapons fired from Russia could cause massive destruction in the UK, the Times of London warned today. The newspaper hides a crucial aspect of this news report from its readership. The thinktank it quoted is funded by the world’s biggest weapons companies: BAE Systems, Boeing, Leonardo UK, Lockheed Martin, Northrop Grumman, Raytheon and Thales. The UK Department of Defence also provides funds. 英國媒體重提「大規模殺傷性武器」騙局:倫敦時報今天警告說,從俄羅斯發射的武器可能會對英國造成大規模破壞。該報向讀者隱瞞了該新聞報導的一個重要面向。該文引用的智庫由世界上最大的武器公司資助:BAE 系統公司、波音公司、萊昂納多英國公司、洛克希德馬丁公司、諾斯羅普格魯曼公司、雷神公司和泰雷茲公司。英國國防部也提供資金.

“Britain is at its highest risk of missile attack since the end of the Cold War,” the paper said, quoting the Council of Geostrategy, a thinktank, mentioning “an acute risk to the British mainland”.

It adds that “Russia, China and Iran are all investing in hypersonic and ballistic missile technology,” and quotes: “As ranges increase, the British Isles will increasingly come under potential threat.”

ECHOES OF 2002

The report, which follows a similar one in the Guardian, is a curious echo of the press’s 2002 notoriously false “weapons of mass destruction” reports that predated the 2003 misbegotten invasion of Iraq, causing the violent deaths of at least 100,000 people.

No respected geopolitical specialist expects Russia to invade Britain now or in the near future.

FOOLING THE PEOPLE

The British people must be fooled into believing an attack by Moscow is imminent, to justify the pending transfer of large amounts of money from the public purse to arms firms and the military.

This is all part of a long-term strategy by US allies to use wealth and weapons to maintain western global supremacy.

In 1948, Washington policy planner George Kennan wrote an influential document, PPS/23 Top Secret, which said the rich west had an unfairly large share of the world’s wealth, while Asia had too little.

Thus, foreign policy planning must aim to “maintain this position of disparity”.

US represents 25% of world’s GDP, But US stock markets represent 65% of the world’s stock market value. It is unsustainable and way out of balance. Morgan Stanley and Goldman Sachs have raised forecasts for China. Global Investors Say Go Long on China. In recent months, U.S. and Chinese stock markets have diverged sharply. The S&P 500 has lost $4 trillion since February. 美國GDP佔全球的25%,但美國股市卻佔世界股票市值的65%。這是不可持續的並且失去平衡. 摩根士丹利和高盛上調了對中國的預測。全球投資人表示看好中國。近幾個月來,美國和中國股市出現大幅分化。自 2 月以來,標準普爾 500 指數已損失 4 兆美元 March 13, 2025

Trump’s tariff war and murky economic policies are sending chills down the spine of the market. All three major U.S. stock indices closed at significantly lows on Monday, with the S&P 500 index falling 8.7% from its historical peak on February 19, wiping out a cumulative $4 trillion in market value, while the Nasdaq index dropped nearly 14% from its recent high.

Amid the collective landslide, Tesla’s stock price has dropped over 53% from its peak last December, with its market value evaporating by approximately $800 billion — equivalent to Poland’s annual GDP.

The direct trigger for such a market reaction appears to be Trump’s ambivalence about the possibility of an economic recession in the US. When asked about US economic outlook during a Fox interview released on Monday, Trump said “There is a period of transition, because what we’re doing is very big…” He added, “If you look at China, they have a 100-year perspective. We have a quarter. We go by quarters.”

The market did look at China. So far this year, the Nasdaq Golden Dragon China Index has rebounded more than 20% from its low point. In February, Morgan Stanley projected that the MSCI China Index could reach 77 by the end of 2025, a target 22% higher than its earlier estimate. Goldman Sachs expects Chinese stocks to attract US$200 billion in inflows and rise by as much as 19% over the next 12 months.

Meanwhile, Citigroup Inc. downgraded U.S. equities from “overweight” to “neutral” and upgraded China to “overweight,” recommending that global investors increase their allocation to Chinese stocks.

Foreign capital is quietly flowing into China.

According to the Institute of International Finance (IIF), a combined inflow of more than $10 billion into both Chinese equities and bonds this January reflects confidence of foreign investors as it marks the first simultaneous increase in both asset classes since last August.

Regional players have showed special interest. The Korea Securities Depository reveals that in February, South Korean investors’ total monthly trading volume in A-shares and Hong Kong stocks reached US$782 million, a month-on-month increase of nearly 200%. This figure far exceeds their investment scale in European and Japanese equities during the same period.

Where is all the foreign capital heading? To Chinese tech stocks.

The optimism in China’s tech sector is buttressed by a myriad of convictions:

First, China’s capacity for continuous technological advancements, evidenced by DeepSeek and Manus, which was launched just last week. Manus is the world’s first fully autonomous AI agent with the ability to handle complex, real-world tasks. Bloomberg even titled its coverage: “China’s Manus Follows DeepSeek in Challenging US AI Lead.”

Second, the profitability of Chinese tech companies-since the start of the year to February 13, the year-to-date cumulative gains of major Chinese tech companies were as follows: Alibaba 39.56%, BYD ADR 34.71%, Xiaomi ADR 30.88%, Pinduoduo 22.52%, NetEase 22.34%, JD.com 10.71%, and Tencent ADR 8.07%.

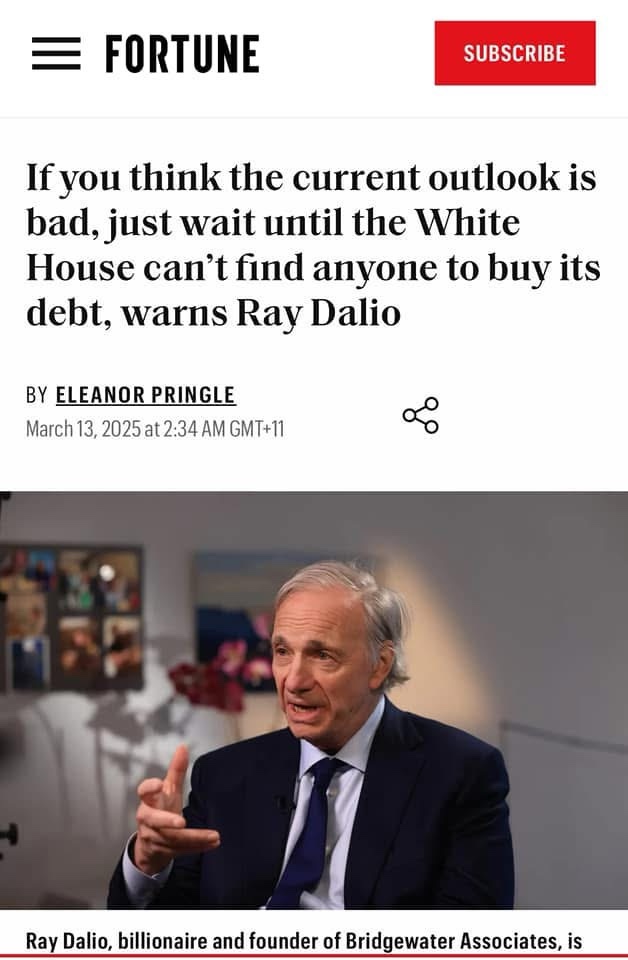

Ray Dalio, the billionaire founder of the world’s largest hedge fund, Bridgewater Associates, once said, “The time to buy is when everyone hates the market and it’s cheap, which is now the case in Chinese equities.”

What Ray Dalio was referring to is this conspicuous gap: even though China’s GDP is already 72% of that of the U.S. The market capitalization of A-shares is only 20-25% of the U.S. stock market. Even when including Hong Kong-listed stocks and U.S.-listed Chinese companies, the total market cap is still just 40% of the U.S. market. While the price-to-earnings (P/E) ratio of U.S. stocks ranges from 20-30 times, the P/E ratio of A-shares is only 12-13 times.

Billionaire investor David Tepper, president and founder of Appaloosa Management, stated in September that he would buy “everything” related to China. In the fourth quarter of 2024, he increased his firm’s holdings in companies like JD.com, Alibaba Group Holding, and PDD Holdings.

Ruchir Sharma, chairman of Rockefeller International, echoes this sentiment, saying that “China is very much ‘investable,’ at the right price.” He added,“China now has more than 250 companies with a market cap of over $1bn and a free cash-flow yield of more than 10 per cent; the US has fewer than 150. Of those 250-odd China stocks, all but about 20 are in sectors other than tech, led by industrial and consumer discretionary businesses, so the opportunities are not just in the internet and AI.”

It would be naive to conclude that winter is coming for the US during this “transitional period”, which can fairly be used to describe both China and the US. Across the Pacific, China is gearing up to move up the value chain, shifting from an economy driven by infrastructure and manufacturing exports to one powered by high-tech development-it won’t happen without an ordeal. When both countries are going through their respective throes, global investors will always be watching, measuring and preparing for their next moves as this game of thrones continues. Our advice? Not a bad time to double down on China.

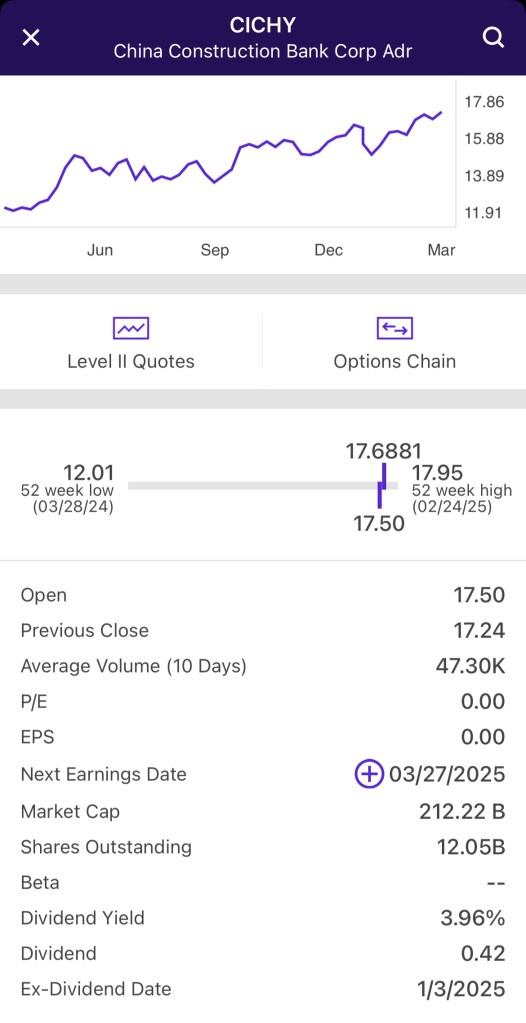

My 3 major stock holdings continues to rise. Current oversell market in US has a bounce back today. It does not mean it will go up again on Monday.

China construction bank I bought it for dividends yields at almost 4% and I am also betting on major banks in US, 100s of them to collapse in coming months! FDIC won’t have enough money to bail them out. If that happens all China banking stocks will shoot up.

See pictures below on what billionaire Ray Dalio is telling us, the big problems US facing is fewer and fewer people buying US treasuries! Do you know how serious that is.

1929 could be around the corner! Cash is king! Sorry not US$, it will be Gold and followed by RMB. Your real estate holdings will drop by 50-70% at least.

Worst if you put all the money in one basket, ALL in the USA, you will be stuck. only God can help you, my friend.

Chris Wat Wing Yin video: This is a deal of handing over a knife to the opponent. Li Ka-shing selling the ports to the Americans is like handing a knife to a robber! This is a heavy deal that affects every Chinese person and even foreigners who have something to do with China. 屈穎妍視頻: 這是一宗向對手遞刀的交易. 李嘉誠把港口賣給美國人,就如同向劫匪遞刀! 李嘉誠是否爲了錢,做人完全沒有底綫?這是一宗影響每一個中國人、甚至跟中國有關的外國人的一宗沉重交易

https://rumble.com/v6qmrza-this-is-a-deal-of-handing-over-a-knife-to-the-opponent.html

https://www.tiktok.com/t/ZP82UXkqP/

https://youtu.be/wU2DKfK6hoM?si=m4YgbEWeO6P-LZi4

想像一下,我是大廈保安,如果每個進出大廈的人都給我每次100元的開門費,幾年之後,我會成為什麼樣的富豪?

連接太平洋與大西洋的巴拿馬運河就是這樣的一條黃金水道,這段世界貿易的咽喉通道,兩邊閘門每打開一次,就需要過路費折合超過100萬港元,所以巴拿馬運河是世界上最貴的收費路段,我國的貨輪每年僅是在這裡繳納開閘過路費,就高達100多億人民幣。

根據巴拿馬運河管理局數據,2024年經巴拿馬運河通行的船舶數目為9944艘,貨運通過量是4.23億噸,總收入為49.86億美元(折合約386億港元)。

於是,美國總統特朗普一上場,就說要奪取巴拿馬運河,因為掌控了巴拿馬運河,就如同搶到一隻生金蛋的雞,閘門一開一關,就財源滾滾。

巴拿馬運河上共有5個港口,香港首富李嘉誠的長和集團自1997年開始擁有其中兩個最大港口:位處大西洋一側的克里斯托瓦爾港(Cristobal),和位於太平洋那邊的巴爾博亞港(Balboa)。

兩港口因位處運河兩頭,位置極佳,大部分進入運河的貨輪都在此集裝箱運作,故2021年時,和記再續簽了25年的港口運營權至2047年,打算長握這盤穩賺不賠的生意。

不過,特朗普「重奪巴拿馬運河」的言論一出,立即令這必賺生意頓時添上政治變數。

今年3月4日,長和發表公告,決定將和記擁有的港口以228億美元全部賣給美國公司貝萊德集團,產業遍佈歐美23個國家43個港口共199個碼頭的泊位及配套設施,當中包括巴拿馬運河兩個重要港口。據英國《金融時報》報道,此宗天價大交易是由96歲的李嘉誠親自督師。

從生意角度看,李嘉誠在特朗普明言打擊的壓力下,把港口脫手,避過無法估量的政治風險,是正常商人的考量方向;不過,從國家大局觀來看,把港口賣給美國人,不單影響中國,更是為特朗普的「巴拿馬美國化」計劃完美助攻。

舉個例,巴拿馬運河兩端港口易手給美國公司後,只要他們改動一點規矩,譬如每艘中國商船通行時每個貨櫃箱加50美元,一年下來就是幾十億甚至百億的損失,長此下去,中國的競爭力肯定受影響。

2024年12月,美國出台《船舶法案》,提出「禁止對中國籍船舶、中國實施運營船舶施行豁免噸位稅和燈塔費。」

2025年2月,美國貿易代表辦公室提出擬對中國啟動「301調查」,要「對在美國營運的港口的中國籍船舶每次入港徵收最高100萬美元港口費」。

這意味著,美國財團貝萊德收購了李氏港口後,覆蓋歐美23個國家43個港口199個碼頭都由美國控制,屇時,無論是中國船舶、還是中國船廠建造的外國船舶,只要進入這些港口碼頭,都要被額外徵收噸位費、燈塔費及100萬美元的港口費。這對我國造船業及航運業將是極大打擊。

全球超過80%貨物是通過海運完成,目前美國在商業造船領域只是排名世界19位,每年建造的商船不到5艘,但中國每年建造的船舶卻超過1700艘,佔了半壁江山。中國更擁有全球19%的商業船隊,掌控全球95%海運集裝箱生產。勤力的人在努力,落後的人追不上,於是,就決定去搶、去打劫。

李氏把港口賣給美國人,就如同向劫匪遞刀,從此,所有跟中國有關的船舶,都要留下買路錢。

所以,這是一宗普通商業交易嗎?抱歉,絕不,這是一宗影響每一個中國人、甚至跟中國有關的外國人的一宗沉重交易。

This is a deal of handing over a knife to the opponent by Chris Wat Wing Yin 2025-03-14

Imagine that I am a security guard in a building. If everyone who enters and leaves the building pays me a door opening fee of 100 yuan each time, what kind of rich man will I become in a few years?

The Panama Canal connecting the Pacific Ocean and the Atlantic Ocean is such a golden waterway. This throat of world trade requires a toll of more than 1 million Hong Kong dollars every time the gates on both sides are opened, so the Panama Canal is a golden waterway that connects the Pacific Ocean and the Atlantic Ocean. The Panama Canal is a golden waterway that connects the Pacific Ocean and the Atlantic Ocean. Every time the gates on both sides are opened, the toll is equivalent to more than 1 million Hong Kong dollars, so the Panama Canal is a golden waterway that connects the Pacific Ocean and the Atlantic Ocean .

My friend from HK in Japan bought 100s of Ne Ji 2 movie ticket and gift it to his friends and clients in Japan 我香港的朋友在日本買了幾百張哪吒2電影票送給他在日本的朋友和客戶

https://youtu.be/ZIuMMs49ev4 👈

It is just the beginning of the nightmare. It is far from over! The worst has yet to come. 這只是惡夢的開始。最糟糕的情況還沒到來!